创意作者:Alexey Kiyanitsa,MQL5 代码作者:barabashkakvn。

该专家顾问基于五个指标(Gator、WPR、AC、DeMarker 和 RSI)的数值进行评估,采用梯形隶属函数。在发送交易请求之前,会检查账户资金是否足够。

参数

double arGator[8] = {0.010,0.020,0.030,0.040,0.040,0.030,0.020,0.010};

double arWPR[8] = {-95,-90,-80,-75,-25,-20,-10,-5};

double arAC[8] = {0.05,0.04,0.03,0.02,0.02,0.03,0.04,0.05};

double arDeMarker[8] = {0.15,0.2,0.25,0.3,0.7,0.75,0.8,0.85};

double arRSI[8] = {25,30,35,40,60,65,70,75};

double Weight[5] = {0.133,0.133,0.133,0.268,0.333};

double arWPR[8] = {-95,-90,-80,-75,-25,-20,-10,-5};

double arAC[8] = {0.05,0.04,0.03,0.02,0.02,0.03,0.04,0.05};

double arDeMarker[8] = {0.15,0.2,0.25,0.3,0.7,0.75,0.8,0.85};

double arRSI[8] = {25,30,35,40,60,65,70,75};

double Weight[5] = {0.133,0.133,0.133,0.268,0.333};

适用于 H1 时间框架。

来自创意作者的提醒:

关于模糊系统的理论材料很多,我们来聊聊这款专家顾问:

1) 该系统根据五个指标(Gator、WPR、AC、DeMarker 和 RSI)的数值进行评估,使用梯形隶属函数。

2) 值的排名和权重可以直接在代码中编辑。

3) 作为模糊评估的基础(买入、卖出、保持观望),你不仅可以使用上述指标,还可以根据自身的判断使用其他方法。

总的来说,这款 EA 代码旨在让大家熟悉模糊评估当前市场情况的技巧。建议在阅读理论后使用或修改它。你可以从 A. Nedosekin 的模糊评估基础材料入手(虽然描述的方法不同,但理论解释非常到位)。

注意:

- 如果想添加自己评估的标准而不是使用五个内置指标,建议将这些标准分割为模糊值的边界(在代码中为数组 arGator[7] 等)。

- 不要尝试过度优化隶属函数的参数(这些参数在代码中不可作为外部参数调整)——这不会产生实质性的效果。

- 尝试进行实验。我认为模糊逻辑在决策方面是无与伦比的。

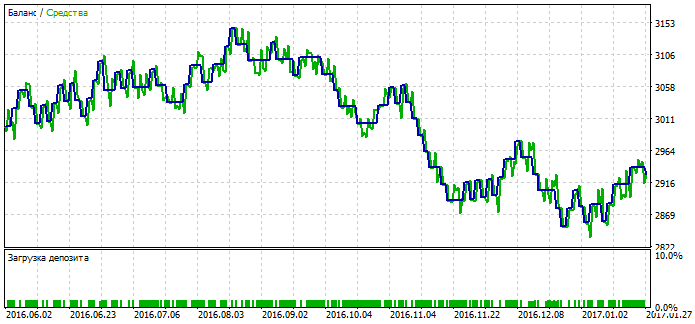

在 EURUSD 的 H1 时间框架中,取得了最佳效果: